NAA Inflation Tracker: October 2022

CPI, Latest Release, September 2022

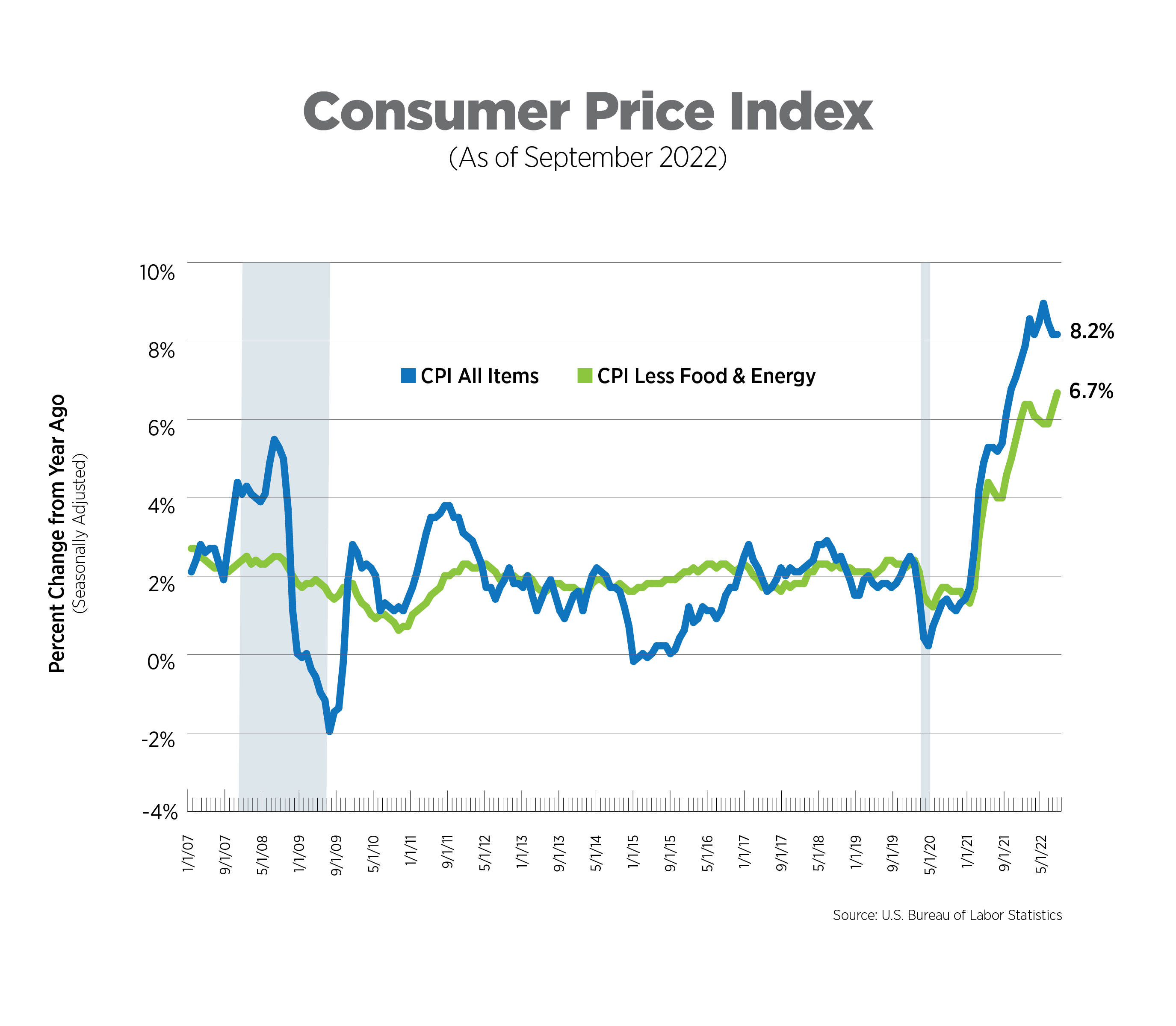

Once again, the latest inflation figures were greater than consensus forecasts, with headline CPI increasing 8.2% year-over-year on a seasonally adjusted basis. Core CPI, which excludes volatile food & energy prices and signals underlying, longer-term inflation, was disturbingly high. The 6.7% reading was the highest of this cycle. On a monthly basis, core CPI increased 0.6%, matching the level in August. Major categories experiencing price escalations of 1.0% or more this month included transportation services, especially those related to motor vehicles, medical services, energy services, and fruits and vegetables.

CPI for Housing, August 2022

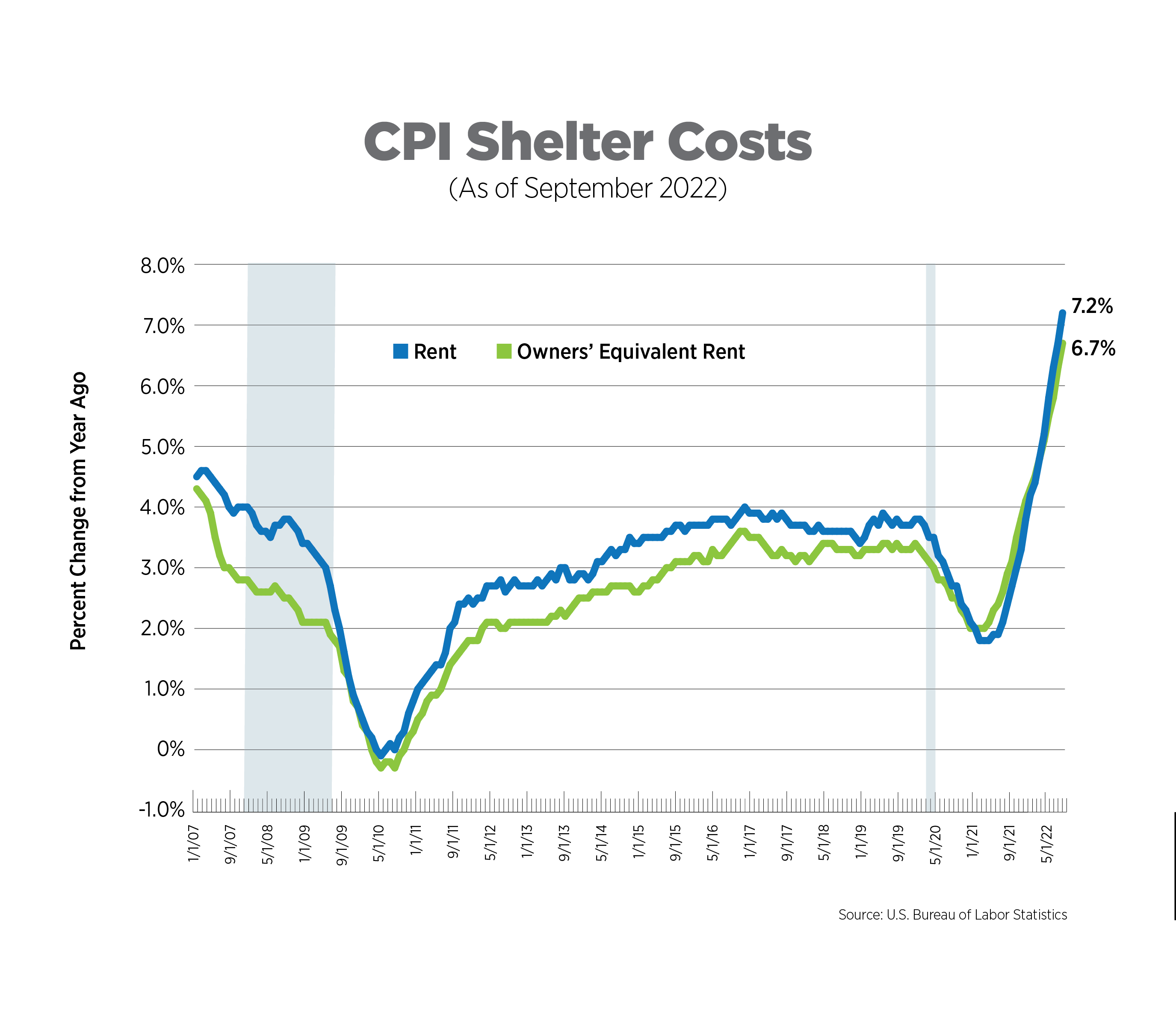

The CPI includes two measures for shelter costs: owners’ equivalent rent and rent of primary residence, both of which are self-reported. Together, they comprise about one-third of CPI. Owners’ equivalent rent, which is the price owner-occupiers think they could attain if they rented their homes, were up 6.7% while rent of primary residence rose 7.2%. Rent of primary residence experienced its largest monthly increase since 1986. Given the lag in CPI rent data reporting, sustained rent growth has been expected, although private sector data providers have clearly shown that rent has already peaked for market rate, professionally managed properties. Until the CPI data catches up, shelter costs will be one of the main drivers of inflation.

Alternative Measures of Inflation, August 2022

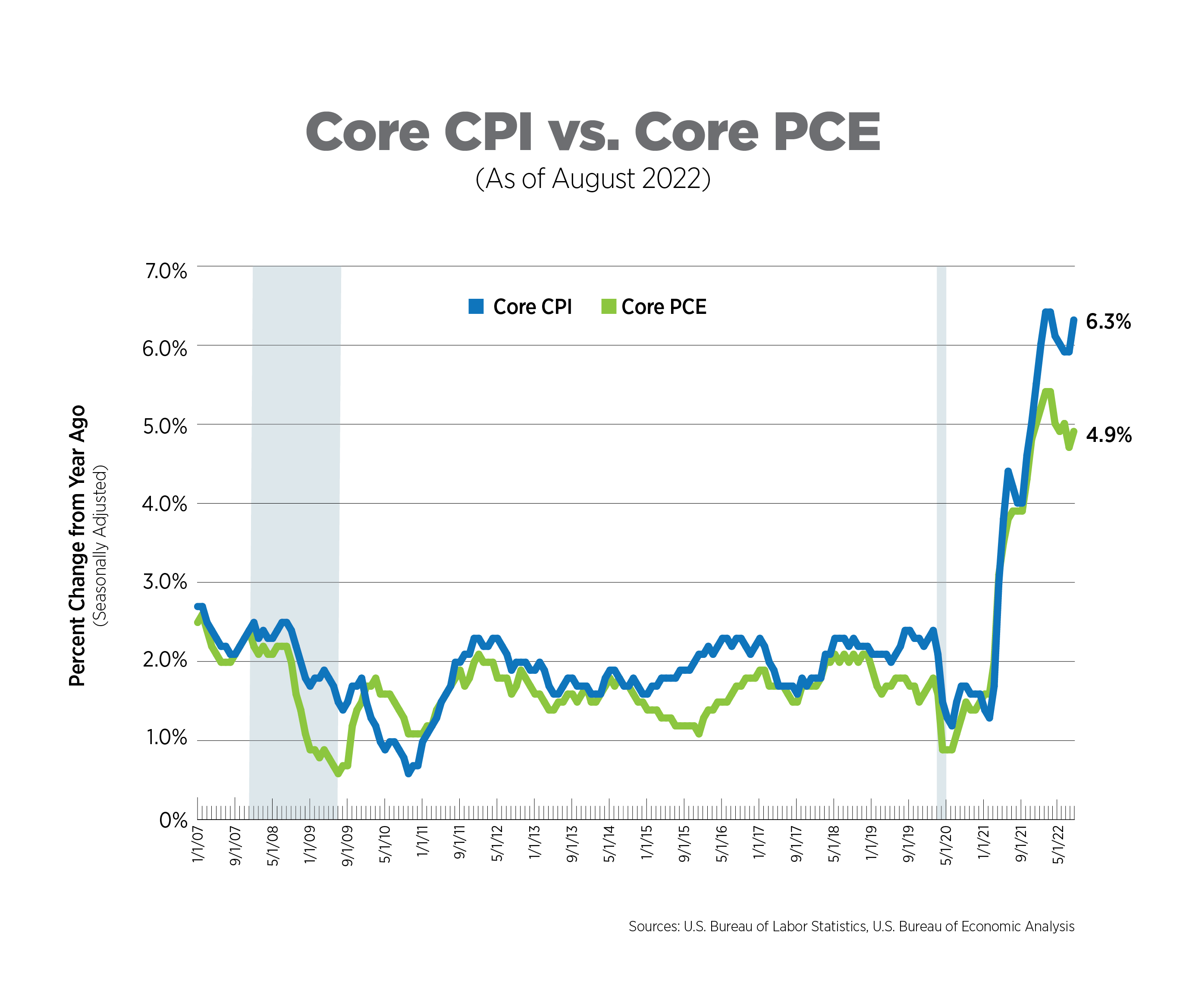

The core Personal Consumption Expenditures (PCE) Index is the measure of inflation the Federal Reserve Bank uses in its policy decisions. It is produced by the Bureau of Economic Analysis and uses different formulas, different weights and has a different scope compared to the Bureau of Labor Statistics’ (BLS) CPI.

The core (excluding food and energy) PCE increased 20 basis points in August, to 4.9%, driven by both services and durable goods. On a monthly basis, prices rose 0.6%, matching the highest rate this cycle and dashing hopes of moderation after last month’s flat reading.

Inflation Expectations, September 2022

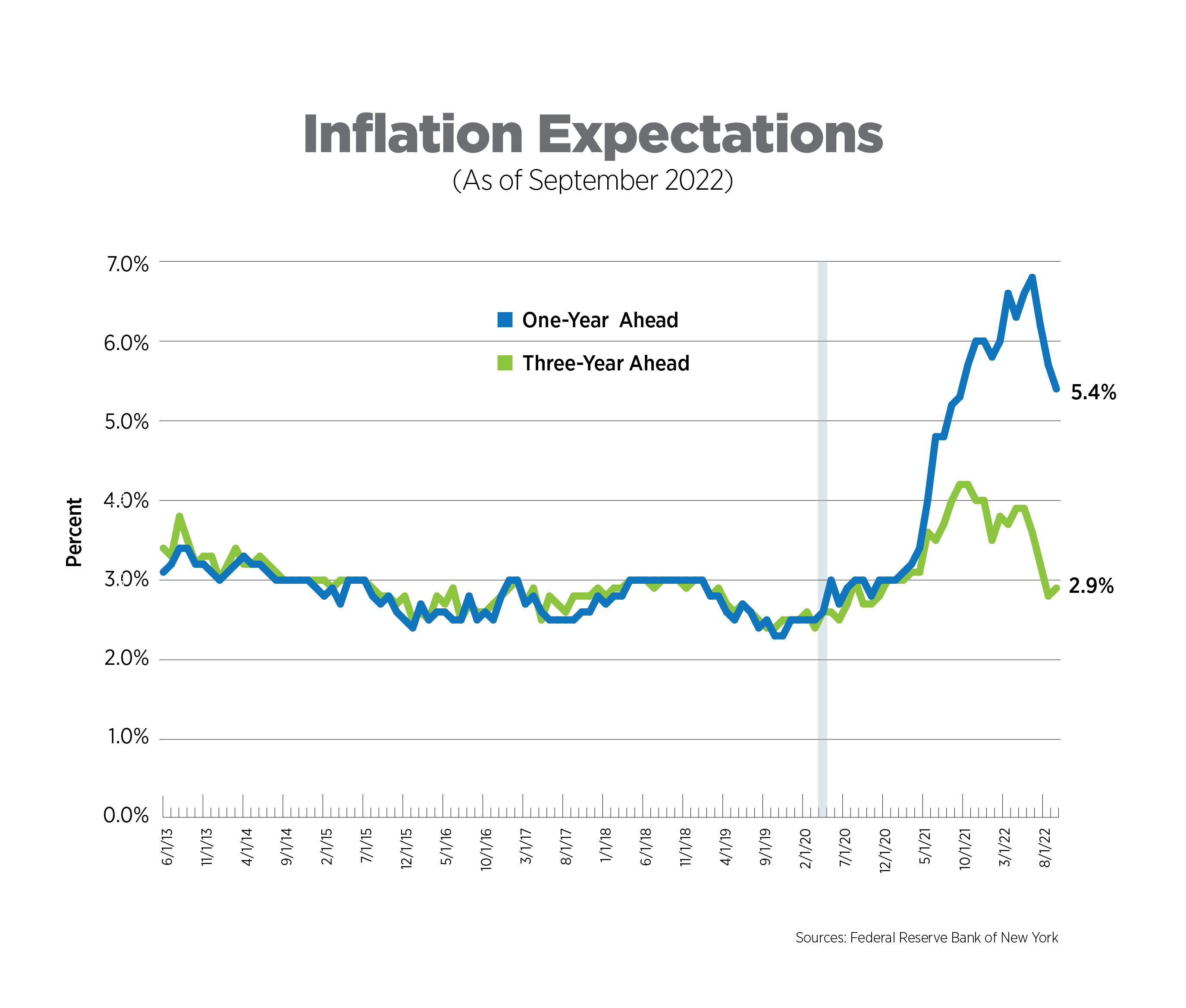

The Fed tracks 21 different measures of inflation expectations. The data presented in the chart below are from the Federal Reserve Bank of New York’s Survey of Consumer Expectations, specifically the median expectations for inflation one and three years from now.

The one-year expectation for inflation has dropped for 3 consecutive months, and at 5.4%, is at its lowest point in a year. Expectations for inflation 3 years from now ticked up slightly but remained below 3.0%. The Fed has explicitly stated that elevated inflation should not become ingrained in consumer behavior and expectations, so this is one positive indicator signaling that consumers do not expect inflation to linger in the long-term.

Wage Growth, September 2022

Wage growth has steadily dropped since earlier this year, from 5.6% year-over-year in March to 5.0% currently. Leisure and hospitality remained the highest wage-growth sector, increasing 7.9% with information closely following at 7.2%. Despite some pullback on consumer spending for goods, employees in the transportation and warehousing sector are still experiencing healthy wage growth of 6.6%. Adjusted for inflation, however, real average hourly earnings for all private sector employees declined 3.0%.

What to Watch in the Next Month

- The labor market may be starting to cool with 263,000 jobs added in September. Still, Moody’s Analytics predicts it will take 100,000 monthly job gains – and preferable fewer – to raise the unemployment rate enough for the Fed to begin to ease up on interest rate hikes. The latest job openings data showed a decrease of 1.1 million openings, the largest decline since the prime pandemic job loss month of April 2020. Conversely, initial claims for unemployment are at levels consistent with a healthy job market. Conflicting labor market data makes the Fed’s job that much more difficult.

- The Fed’s next meeting is November 1-2, meaning this inflation report, the next PCE report, and the quarterly Employment Cost Index, both scheduled to be released on October 28, will weigh heavily on the magnitude of the next interest rate increase. A 75-basis point increase in each of the next two months remains highly likely.

Next Tracker: November 10, 2022